Why Use Credit Cards on PowerBase

Credit Card processing allows your PowerBase site to use the online and offline contribution pages to accept donations directly into the database and your bank account at the same time. You can also set up events that charge fees and accept payments on line. If your organization’s online pages accept payments this way, you’ll immediately connect the payment information with the individual who made the contribution.

This means you will have less work trying to keep the donation and event registration in sync with the individuals’ database records. PowerBase gives you the tools you need to develop a 360 degree view of each person’s participation in your organization and accepting payments through a credit card processor is one more step in closing the data gap. It’s far better to have the payment information in the database instead of a tracking spreadsheet, which leaves some information out of reach to most of the staff.

Here's a Quick Summary

PTP recommends that groups use the Stripe payment processor. We made this choice for a number of reasons:

- Stripe is easy to use and easy to reconcile transactions with PowerBase

- It supports ACH bank transfers

- It relies on open-source software

If you are in a hurry to setup a payment processor, we suggest that you get an account with Stripe and let us know so we can enable the appropriate module and get you started.

Overview of Credit Card Processing

When you set up your PowerBase to handle credit cards, you are connecting to a confusing and complicated financial system.

As you research it, you’ll hear a lot of terms:

- Merchant account – a financial account through which credit or debit card payments are accepted. It is a line of credit account, not a deposit account.

- Online Merchant Account – this is a specific type of Merchant Account that uses an online payment gateway to process payments. We will be setting up an internet merchant account to handle payments in PowerBase

- Acquirer – a financial institution that handles the contractual agreements for processing credit and debit card transactions from customers. Non-profits have a merchant account at an acquirer when they set up credit card processing. An acquirer provides “merchant services”, which is primarily accepting credit and debit card payments and depositing them into a bank account, but can include other services such as automatic recurring billing (ARB), online payment processing, gift cards and check acceptance. The deposit account does not need to be at the acquirer bank, although it will try to get you to use it.

- Payment Gateway – A payment gateway is an e-commerce application service provider service that authorizes payment transfer between a payment portal (such as a website, mobile phone or IVR service) and the Front End Processor or acquiring bank.

- Setup Fees – some processors require a startup fee to set the account up.

- Merchant discount rate – the rate this is charged for converting the credit or debit card into cash. Some of the discount rate can go to the payment gateway and some to the bank. The discount rate can be higher for “card not present” charges, but this should only apply to merchandise sales, not donations in which there is not product exchanged. It will usually be higher for payment processors that do not charge a monthly minimum, such as PayPal Standard

- Monthly Account fees – There may be monthly charges that will be broken into different components: Statement fees, PCI compliance fees.

- Transaction fees – these are per item fees ranging from 19 to 30 cents. Credit Cards can be divided into a couple of categories. Visa and MasterCard license their brand to banks who act as acquiring banks. Those acquiring banks issue credit cards. They also will sign up other banks which will also issue the Visa or MasterCard credit and debit cards. Amex and Discover issue their own cards.

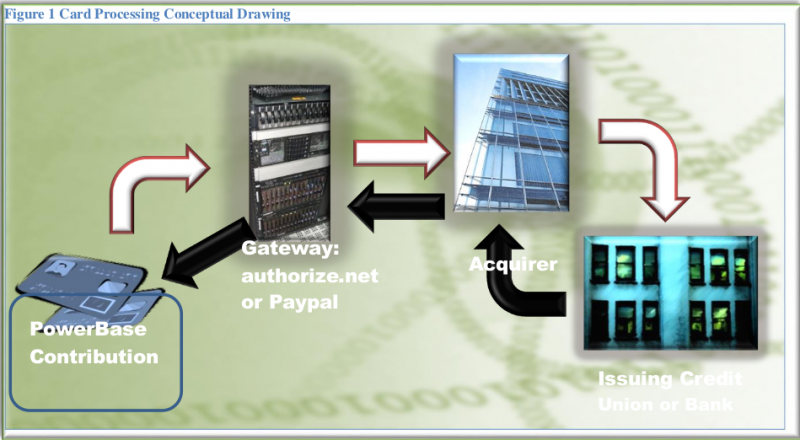

There are some variations in the information flow, such as when PayPal is used by a PayPal member, but this diagram reflects the basic version how the money flows. When a donation is made online, the payment processor link in CiviCRM uses the password and user information that you provide to contact the computers at your payment processor gateway to send a request for authorization. PowerBase establishes an encrypted secure connection to whatever processor you select. While this isn’t a perfect system, it provides a high quality private connection that meets industry standards.

This request ultimately gets forwarded to the card issuer (a bank in the case of Visa and MasterCard, American Express for AMEX cards) who checks whether the card information is properly formatted and whether the person has credit or, in the case of debit card, funds available for the donation. If so, approval comes back to your CiviCRM page and the donor continues on to the next page in the process. If there is a mistake in the card information – the address is inconsistent with the card owner’s address, for instance – then a message is displayed indicating that the charge was declined. The message is not always clear as to the reason for the failed donation, so it sometimes takes some interpreting to figure out what happened. In most cases, the donor can correct her entries and retry the contribution.

Payment Processors in CiviCRM

PowerBase is a specialized installation of a free and open source software application called CiviCRM (http://www.civicrm.org). CiviCRM, like most open source software, is built over a number of years by a number of contributors who add components that they need for their organization, which are then contributed back into the basic system for others to use. With respect to our need to handle credit and debit card processing, the CiviCRM component that most concerns us is called the Payment Processor, which is used in several modules: Event, Membership and Contributions.

You can get to a list of the available payment processors on the civicrm.org site here. Many of them are for organizations outside of the United States and are not relevant to this discussion. We’re going to recap the ones that are in uses by some PowerBase users as of the date of this document and offer an opinion about which is best for typical situations. You needn’t go with any recommendations that we provide here. We can’t guarantee that you’ll have a great experience with any of them. We don’t control them. We are only providing this information as a tool for you to use as you evaluate solutions for your card processing needs. Feel free to contact the Support Team at PTP via email support@progressivetech.org or phone 512-782-8478 to learn if there have been any updates.

As you prepare to select a payment processor, you should consider the volume, frequency and size of your donations. The lowest discount rate comes with processors that have a minimum monthly fee, so you should have enough volume to justify the monthly charges. If you only collect funds once or twice a year during an annual campaign, then you are better off with the provider that does not charge monthly fees.

Check the options carefully if you are setting up a sustainer program and want recurring donation support. Finally, some programs integrate well with CiviCRM donation pages. PayPal Standard, on the other hand, takes the online donor to another page and can confuse people who believe they have to have a PayPal account to use it.

If you expect to collect donations at the door or at a silent auction, you should look for a processor that is supporting the new credit card devices that connect to a mobile phone. This isn’t covered in this paper, so you’ll have to talk to the provider as you make your selection.

If availability of funds is an issue, look for a processor that promises quick delivery into your bank account. You might check with your bank or credit union to see who they recommend as a reliable processor. You don’t have to go with the company they recommend.

There are some new processors that bypass the traditional models. They may be cheaper and offer attractive features, but keep in mind that your organization’s money will be under their control between the time the charge is approved and the funds show up in your bank account. Make an evaluation of their reliability and survivability as you consider them.

Prices last updated Spring 2015

| Payment Processor | Paypal Standard | Paypal Payments Pro | PayPal Payments Advanced | Authorize.net with Dharma Merchant Services | Click and Pledge | Stripe |

|---|---|---|---|---|---|---|

| Setup Fee | None | None | None | $49 | None | None |

| Discover Card merchant rates | 2.20% | 2.20% | 2.20% | 1.92% | 3.50% | 2.90% |

| Visa merchant rates | 2.20% | 2.20% | 2.20% | 1.92% | 3.50% | 2.90% |

| MasterCard merchant rates | 2.20% | 2.20% | 2.20% | 1.92% | 3.50% | 2.90% |

| American Express merchant rates | 2.90% | |||||

| eCheck | available | 1.85% | ||||

| Authorization fee per transaction | $.30 | $.30 | $.30 | $.27 | $.35 | $.30 |

| American Express Cards | $.30 | |||||

| Monthly Fee | $.00 | $30.00 | $5.00 | $25.00 | $20.00 | $.00 |

| Monthly Product Regulatory fee | ||||||

| Recurring Billing Fee | $10.00 | $10.00 | $10.00 | $.00 | ||

| PCI Compliance annual fee | ||||||

| Integrated into CiviCRM donor page? | No | Yes | Yes | Yes | Yes | Yes |

| Handles Recurring Contributions? | Yes for PayPal members only | Yes | No | Yes with ARB charge | Yes- not reliably | Yes |

| Notes | We do NOT recommend this because it requires each donor to make a PayPal account for recurring contributions | Use the Payment Processor labeled “Paypal - Website Payments Pro” | Prices are set by resellers so these are estimates. | See the manual |